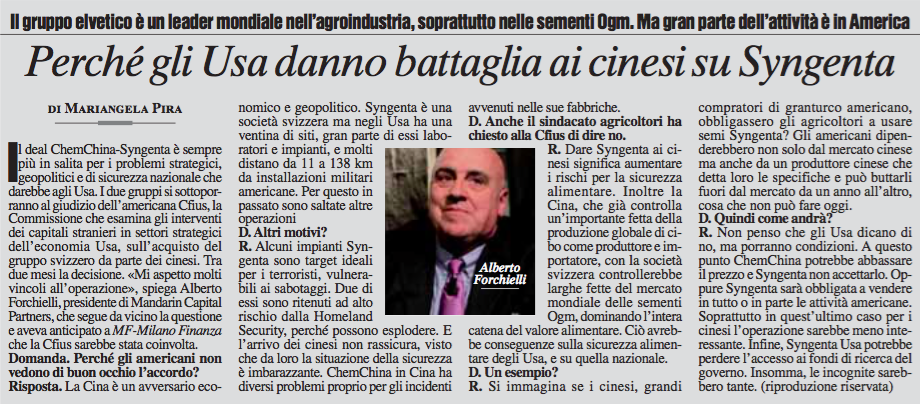

The ChemChina-Syngenta acquisition is increasingly insecure as a result of strategic, geopolitical, and national security problems that undermine the operation. Both groups will submit themselves to a final decision from the US Commission on Foreign Investments in the US (CFIUS), which is charged with scrutinizing foreign investments in strategic sectors, relating to the Chinese acquisition of the Swiss group. The decision will be announced within two months. “I expect many obstacles to the success of the operation,” explains Alberto Forchielli, president of Mandarin Capital Partners, who has been following the deal closely and anticipated at Milano Finanza that CFIUS would surely be involved.

Why doesn’t the US want this deal?

China is a geopolitical and economic adversary. Syngenta is a Swiss company, but it has about twenty factories; the majority of its labs and plants are in the US and many are from 11 to 138 km from American military bases. These reasons have blocked other investments.

Are there other reasons?

Some Syngenta manufacturing plants represent ideal targets for terrorism, and are vulnerable to sabotage. For example, the US Department of Homeland Security considers two of the Swiss company’s factories high risk because they could explode. The Chinese chemical industry is not reassuring considering that, in terms of secutrity, it’s embarrassing. In China, ChemChina has had a series of problems due to accidents that occurred in its factories.

Even the agricultural lobby asked CFIUS to block the acquisition.

Giving Syngenta to the Chinese means increasing security risks when it comes to food supply chains. But it also means that in buying the Swiss company, China–which already controls a healthy slice of global food production both as a consumer and a producer– would control important percentage of the global production of GMO seeds, and would dominate the entire added value chain in the foodstuffs sector. This would have consequences on food safety in the US, and even more on national security.

For example?

Imagine the problems if the Chinese, huge buyers of American grain, obligated American farmers to use Syngenta seeds. The Americans would be not only beholden to the Chinese market, but also to a Chinese producer that could dictate its terms and exclude the US from the market whenever it wants, something it can’t do today.

Which is to say, China could acquire resources to produce food. So how will it turn out?

I don’t think the American government will say no, but it will impose conditions. A hypothetical scene could see ChemChina lowering its asking price and Syngenta refusing it. Or, Syngenta could be required to sell part or all of its American operations. Especially in this last case, the entire operation would be less appealing to the Chinese. Finally, Syngenta USA could lose access to US government research funds. There are many unknowns.

Lascia un commento