Dr. Kai Pflug, CEO, Management Consulting – Chemicals (Ltd.)

Dr. Bernhard Hartmann, Managing Director, A.T. Kearney China

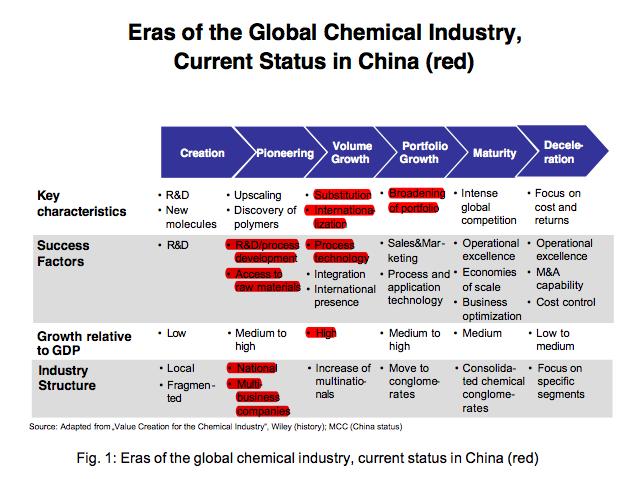

Most Chinese chemical industry participants would agree that the domestic industry is not yet as developed as the chemical industry in the West. The question then is whether Chinese companies can learn from the history of the chemical industry, thus accelerating their own development. Fig. 1 gives a general overview of the different development phases the global (or more specifically, the Western) chemical industry has gone through since its foundation in the 19th century.

It is a relatively typical industry life cycle, going from the very first, primarily research-oriented phase via three distinct periods of strong growth to a phase of maturity and eventually to a deceleration. Along with these key characteristics, a number of other aspects change. For example, the initial focus on R&D alone changes into one on industrial manufacturing, then on to selling the chemicals produced, while lately the focus at least on mature commodities is mostly on cost efficient production. Other aspects changing depending on development phase are the growth rate and the structure of the industry. To be able to draw any lessons for Chinese companies from this development history, first the current stat us of the Chinese chemical industry within the scheme must be determined. Such a determination may not be absolutely conclusive, but the preliminary results of such an assessment are indicated by the red boxes in Fig. 1. In particular, the assessment is as follows:

* Key current characteristics of the Chinese chemical industry are substitution (e. g., of metals by plastics in automotive, of oil by coal in petrochemicals), internationalization (as indicated by the recent overseas acquisitions both by the petrochemical SOEs and by companies such as Sinochem and Bluestar) and the broadening of portfolios

*Key success factors are the increasing focus on R&D/process development (as indicated by the increased research activities of many Chinese chemical companies) and the securing of raw materials (particularly for the Chinese petrochemical companies, which have gotten more and more active in overseas oil exploration)

* Growth rates in chemical production value are much (approximately 20%) higher than GDP growth

* Domestic chemical companies are still primarily national rather than global in their activities, but they generally are already active in many different sub segments of the chemical industry

Overall, if assessed by the scheme presented in Fig. 1, the Chinese chemical industry indeed is still at a relatively early stage, with many aspects characteristic of what is named the “volume growth” phase in the figure. Assuming that China’s chemical industry will take a similar development path as the global chemical industry, what are the key lessons Chinese companies can take from the subsequent industry phases already passed through in the West? They can be summarized by three key points, namely operations improvement, internationalization and specialization.

Given the large number of qualified engineers and scientists in China (both in academia and in chemical companies), it is unlikely that China will have substantial problems in optimizing chemical operations and thus also controlling the costs reducing the raw materials requirements of domestic chemical plants. The other two points merit some more consideration.

Internationalization of the Chinese chemical companies is still at a very early stage, particularly if those overseas activities are excluded that only aim at procuring raw materials. The true importance of internationalization lies in getting a global market presence. Neither the Chinese chemical companies that do export a substantial share of their production nor SOEs focusing on procurement of raw materials abroad have this presence. In contrast, a company such as the German Evonik sells more than 70% of its production outside of its home country and has production and distribution sites in more than 50 countries. Instead of taking the example Evonik, essentially any major Western chemical company could be used. Clearly, the advantages of an international presence, such as extending sales in new regions, finding new markets for older products, getting closer to existing customers, getting more attractive for global customers, reaching better economies of scale and optimizing the cost structure of production, are highly relevant. Given that organic growth, i.e., opening of own branches overseas, is time-consuming, this internationalization very likely will require the acquisition of overseas companies by Chinese players.

Specialization is the other key difference between the chemical industry in developed Western markets and in China. In many ways, the current wave of diversification of Chinese companies is a reminder of Western activities about 30 years ago. However, in the last 10-15 years, in the West, the momentum has clearly shifted towards a stronger focus on specific chemicals segments – or “specialization” in one word. Depending on the size of the companies, specialization can have a slightly different meaning – obviously a large company can afford to specialize in a bigger area than a small one. But the basic idea of becoming a market leader in a small or big sub segment is the same. Again, the advantages are numerous: Specialized companies can focus on those areas in which they have an initial competitive advantage, and concentrate their management resources in that area. The smaller competitive field strengthens the competitive position of the company and allows it to gain deep expertise, build a credible brand and to expand on core strengths. Sadly, an examination of the broad and diversified portfolios of Chinese chemical companies frequently shows that these advantages have not been understood yet.

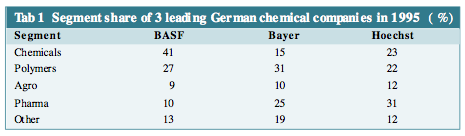

Once specialization has been accepted as a strategic goal, which area should a Chinese chemical company focus on, which should be ignored? The history of the chemical industry in Germany again gives some hints. In the 1990s, Germany was the home of three global leading chemical companies, BASF, Bayer and Hoechst. Their share of sales in different chemical areas is listed in Tab. 1.

In the subsequent years, BASF sold its pharma activities. Bayer spun off its chemicals activities (to form LANXESS), but kept the majority of its businesses. Hoechst took the most radical step and eventually only kept the pharma business. While each company gave a different rationale for the path taken, the table indicates that probably the main reason for each company was to keep its areas of core strengths (those with the highest sales) and divest the other parts. For BASF, divesting a relatively small pharma business thus was easy despite the attractive margins typically earned in pharma, while for Hoechst, it was an easy decision to focus on pharma from an existing position of strength. Only for Bayer, such a decision was difficult as both pharma and polymers were very important contributors, leading to the somewhat awkward step of separating the related businesses of chemicals and polymers while keeping the much less related pharma and polymer businesses together. The lesson for Chinese companies thus is to identify the strongest areas of their business and to focus on these in their quest for specialization.

In summary, since the 1970s, Western chemical companies underwent deep transformations. Internationalization and specialization were the two major processes. If China’s chemical industry aspires to be competitive on a global scale, the same transformation needs to occur in China – though in a much shorter period of time. For those Chinese companies that aspire to be among the top level of global chemical companies, this will require substantial and well-structured efforts with regard to both processes.

Dr. Kai Pflug, CEO, Management Consulting – Chemicals (Ltd.)

Dr. Bernhard Hartmann, Managing Director, A.T. Kearney China