Last year, China’s economy with less than 15% of the global GDP was contributing by 40% to the global growth. In 2014, China’s economy has started changing course. With the manufacturing sector dropping to 42.7 and the service sector accounting for 48.1 of total economy in 2014, Chinese economy is clearly heading to re-balance its economy towards services and consumption.

In August, a plummeting Shanghai stock market, and the Renminbi devaluation wanted by the government, have turned the above picture into a nightmare. Fears of a sudden hard-landing, questioned the strength of past achievements, and the country’s prospective role on world stage.

What mostly concerned the international public opinion was the intended devaluation of the Renminbi against the US dollar. In two days, Beijing quickly engineered a 3% devaluation of the yuan in a “one-off” operation, causing panic among financial markets around the world.

As the devaluation came barely days after data show a sharp fall in China’s exports. PBoC explanation that the move was motivated by market-oriented reforms didn’t convince media analysts. Observers realized that the Chinese authorities, in an attempt to gain price competitiveness and market share, were just reverting to the old fashioned mercantilism, abandoning years of the “Strong Yuan” policy. Even more, fears that China was engineering a counter-move against developed central banks’ “quantitative easing” emerged that a currency war was just in the making.

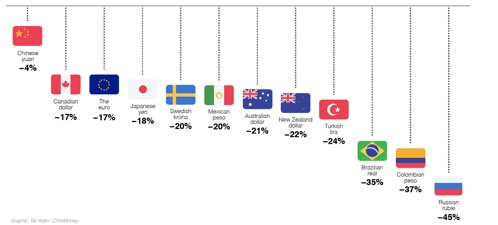

Yet, looking through the numbers, the Chinese RMB devaluation by 4% against the US dollar, is as tiny as insignificant to declare a mercantilist strategy.

For a credibly mercantilist strategy (to gain price competitiveness against its competitors), the August devaluation should have been at least around 20-30%. In fact, from 2007 to 2014 the RMB real effective exchange rate appreciation accounts for 35 per cent against the five reserve currencies. The four SDR member currencies (the dollar, euro, yen and sterling) had registered 5 percent to 15 percent real effective depreciation. Especially vis-à-vis the yen, RMB appreciated noticeably between 2007 and 2012 until the start of the so-called ‘Abenomics’, RMB lost competitiveness by March 2014 by 30 percent from its peak in 2011 (Alicia Garcia-Herrero, 2015).

All in all, as Nicholas Lardy of IIE of Washington wrote: ‘If they [Chinese authorities] wanted to revert to their mercantilist trade policies, they would have moved sooner and they would have moved by a much bigger amount”.

Yet, the PBoC actions on the RMB exchange rate, if read in the details, offer a cute and more upbeat story, more strategic than defensive. By giving up the US peg, and allowing the devaluation of the RMB according to a market valuation, Chinese policymakers were just doing the right thing, at the right time. By taking action on the RMB exchange rate via de-pegging it from the US dollar, and adopting a market-based opening rate, the PBoC has performed a masterstroke. While committing to the IMF guidance, as expressed in July to make the RMB exchange rate more market-based, the PBoC has stepped up the admission of the RMB among the IMF reserve currencies. Freeing hands on exchange rate, PBoC will have more room for manoeuvre on the currency’s rates, at a time the central bank mostly need to accommodate via monetary policy the complex country’s economic cycle.

In the international economy, the August move has triggered some interesting effects. Besides the obvious revaluation of the dollar and the impact on the US exports, a surprising fact is that for the first time, since the Bretton Woods arrangements, the Fed’s independence on the rate policy has suffered clear limitations. Ms. Janet Yellen circumspect arguments offered on September 17 at the press conference showed to what extent China is starting to play a role on the US Fed’s monetary policy.

What’s the follow-up of the August actions?

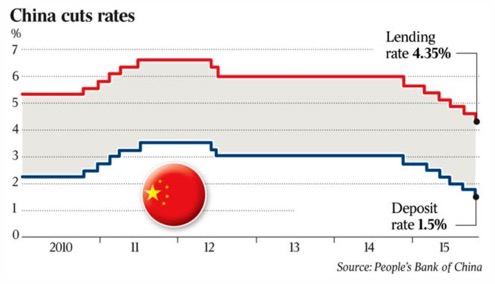

In the last weekend of October, China has launched a major financial system reform by removing the cap that banks set on deposits rates, an important move to free up the nation’s interest rates, while cutting the official interest rate for the sixth time in a year.

These actions were aimed, according to the PBoC, to spur growth in China’s economy by cutting one-year lending rates by 25 basis points from to 4.35 per cent for businesses and commercial purposes, while the one-year bank deposit rate would be sliced from 1.75 per cent to 1.5 per cent. Yet, in a calculated move to prickle the potential of a housing bubble in the country’s major cities, the reduction in the official lending rate did not apply to mortgages.

Further in a significant move, the Chinese central bank said it would remove the “deposit ceiling”, which meant the banks could set their own deposit rates, which, according to economists is a major step for the central government in its promise to implement financial market liberalisation.

On the Reserve Requirement Ratios- the levels of capital that banks must hold- the PBoC announced it would allow cut by 50 basis points but some provincial banks would be given extra relaxation of the rules to help boost lending in lower tier areas.

As John Zhu of HSBC said “The biggest move are the changes of the deposit rates. They [Chinese policymakers] are easing monetary policy but they are liberalising the financial system”, and at the same time that decision was made “in a bid to tighten the lending criteria for Chinese companies rather than rewarding the nation’s retail customers who have one of the highest saving rates in the world”.

In conclusion, the August actions have just started China’s journey to financial market liberalization, which will upgrade the country’s economy to more efficient asset allocation.