The automotive industry in Mainland China has been a cash cow for mass market and premium car brands for the past several years. Major international carmakers decided to enter China as soon as they realized the importance of their presence in such a big, profitable market. For many international carmakers, the choice to enter the country demanded large investments in order to that build manufacturing plants and better supply the increasing demand.

Nonetheless, the Chinese automotive industry is now struggling against the market’s fast changing conditions. The rapidly evolving industry combined with slower growth is threatening many segments and actors in this dynamic environment. As a consequence, the future outlook for the automotive industry is uncertain; because of its high volatility, it is difficult to make accurate predictions.

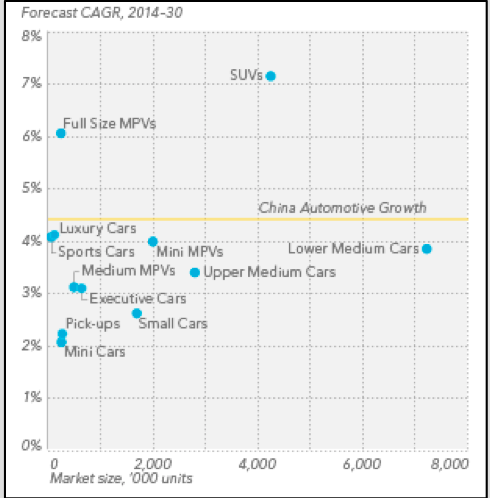

There are many drivers at work behind the recent sales slowdown, both macro and micro. It is not easy for the market actors to defend the double-digit operating margins that the Chinese market provided just a few years ago. From a macro perspective, the economy suffered its slowest growth rate in a quarter century. In addition, China’s trend rate of growth is forecast to slow gradually to around 4% by 2030. The decreasing trend rate of GDP could also have strong impact, as the automotive industry is a cyclical sector. As we have seen with the financial crisis in 2009, in a slowing economy the automotive sector suffers more than other industries.

In June 2015, the China Association of Automobile Manufacturers (CAAM) reported that the production and sales of automobiles in China reached 1,850,800 and 1,803,100 units, respectively, down 5.8% and 5.3% compared to the previous month, and down 0.2% and 2.3% year-on-year. It’s the first year-over-year decline in monthly auto sales in more than two years in China. For the first half of 2015, the production and sales of automobiles were 12,095,000 and 11,850,300 units respectively, up 2.6% and 1.4% year-on-year. However, monthly cumulative growth continued to decline. Total vehicle deliveries including trucks and buses will probably rise by 3 percent this year, down from the 7 percent projected by CAAM in January. That would be the smallest increase since 2011.

On top of the current downturn in the automotive industry, China will see more manufacturing capacity added. Since the major companies have long-term plans in China, they continue to invest big money. Among these, Hyundai Motor Co. is building two more plants in China by next year, while Renault SA has a factory set to open in the first half of next year. The Italian company Fiat SpA is set to start making Jeeps in China later this year. Moreover, last year Volkswagen AG said it would invest more than 22 billion euros ($24.5 billion) in China by 2019 with its local partners. In April, GM’s joint venture with SAIC Motor Corp. said it plans to spend 100 billion yuan ($16 billion) by 2020 to compete for market share in China.

The different segments comprising the market have been impacted differently. As for passenger cars by type, compared to the same period last year, SUVs continued to experience high-speed growth with production and sales up 47.55% and 45.94%, respectively. Multi-purpose vehicles (MPV) also enjoyed a double-digit growth, with an increase of 16.4% and 15.3% in production and sales, respectively. The high sales value of both SUVs and MPVs is mainly due to two factors. The first is household size. Unlike most markets, the number of 6+ person households is holding fairly steady as generations continue to share single homes, keeping full-size MPV sales relatively stable but also supporting full-size SUV sales. The second factor is the increasing preference for big cars in China. Wealthy consumers are more likely to consider buying SUVs than the rest of the market. Purchasing an SUV allows them to not only satisfy their driving needs, but also to show off their personal taste and lifestyle. Although “going bigger” is clearly a trend, there are still strong sales opportunities in the small car segment, especially as new urban lifestyles emerge.

The image below depicts the forecast of passenger cars by type according to Euromonitor International.

Something very unusual happened in China’s passenger vehicle market in the first quarter of 2015: China’s domestic brands grew much faster than the overall market. Over the past few years, Chinese automakers struggled to catch up to western companies’ technology, thereby investing a considerable percentage of their budgets in R&D.

According to surveys by JD Power and others, in 2014 Chinese brand quality reached the level of foreign brands in 2011. The quality gap is rapidly shrinking and consumers are becoming discerning enough to move beyond the inferred social status of the vehicle brand. As domestic brands are investing in marketing to communicate their value to customers, their market share is gradually increasing, and they will challenge the high margins gained by foreign automakers in the near future. Therefore, under increasing pressure from local carmakers, foreign automakers have resorted to offering discounts to try to narrow the price gap and spur sales. For instance, Volkswagen AG and General Motors Co., which count China as their largest market, have cut prices to defend market share as demand slows and domestic rivals lure increasingly value-conscious customers with cheaper SUV.

Another fresh phenomenon expected to aggravate the Chinese automotive industry’s downturn is the recent stock market drop. Indeed, the plunges in China’s stock markets and crumbling consumer confidence have fueled economic uncertainty. Since many Chinese people lost parts of their incomes in the recent unexpected sell-offs suffered both by the Shanghai and Shenzhen stock exchanges, disposable income will temporary decrease.

One more reason for concern is the limitations on new car sales imposed by the local authorities in Chinese cities. Their purpose is to reduce both congestion and pollution in heavily congested areas, and new laws have been enacted for this goal. The complex process required to obtain license plates in China’s tier 1 cities presents a noteworthy limitation. Differently from what happens in the rest of the world, Chinese citizens desiring to buy new cars must participate in a lottery to win rights for a license plate. The lottery-based system fuels a black market for plates, where wealthier people are able to pay a lot in order to obtain plates. Another type of limitation is present in Beijing: public authorities continue to limit the number of cars in rush hours using license plate numbers to ease congestion. The restriction, which bans cars based on odd and even license plate numbers, is aimed at improving air quality and cutting traffic.

Furthermore, China’s passenger car market is undergoing a major structural change. The country has developed a used car market for the first time in its history. Buyers in the world’s largest auto market now have much more choice, and are no longer forced to buy new cars. One key advantage of a used car is that it comes with a license plate.

On one hand, lower oil prices are supporting short-term demand. But on the other hand, the introduction of brand-average fuel economy targets is opening the market to Electric vehicles (EV). China, the world’s biggest carbon emitter, is mandating that at least 30 per cent of new government vehicles be powered by alternative energy sources by 2016 in the government’s latest move to combat pollution. Aside from the relatively low purchase price of EV because of the numerous initiatives in effect, there is less aversion to electric vehicle technology than in more developed markets. The future outlooks for the EV market are optimistic. Given the small base represented by EV today in China, the future growth rates of this segment are expected to be notable.

Overall, despite the downturn, the automotive market is still far from a crisis. The market still has room to grow, especially in China’s smaller cities where more and more automotive sales are expected. That being said, the set of changes facing carmakers in the near future is daunting. To survive in such a dynamic environment companies should move faster than the market itself, trying to anticipate changing conditions and new trends.