The Chinese economy is slowing down; China won’t achieve its anticipated annual GDP growth rate. Although Beijing is struggling to acknowledge the country’s worsening macroeconomic condition, indicators clearly reflect the difficulties the Chinese government is facing.

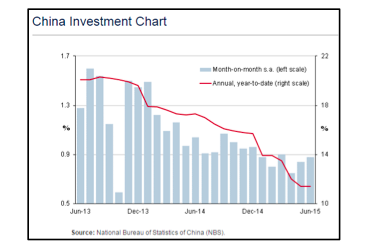

The investment growth rate represents one of the most relevant indicators for an economy driven by investments. At a first glance, the chart below clearly shows that investment trends have been worsening over the past couple years.

An additional concern regarding investment levels for the coming months arises from a recent government announcement: Beijing has placed a cap on local government debt. The decision had been rumored, and it became a reality a few weeks ago. It will create restrictions on new investments. Local governments won’t have the freedom they were used to when making investment choices. Beijing is trying to centralize investment decisions to better control soaring public debt.

There is another concern for Beijing that is not reflected in the H1 data on investments. According to Dariusz Kowalczyk, senior economist and strategist at Credit Agricole, the data failed to reflect the impact of the recent equity market crash, which reduced consumer spending power and diverted bank lending away from the real economy and into the government-orchestrated equity buying. Fewer funds in the real economy will further tighten investment levels.

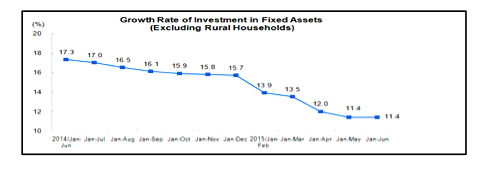

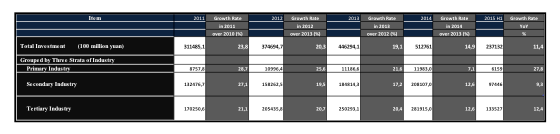

Let’s talk about numbers. Overall fixed-asset investment, a crucial driver of the world’s second-largest economy (excluding rural), rose 11.4% year-on-year in the first half of 2015 according to data released by the National Bureau of Statistics. Investments in H1 accounted for 23,713.2 billion Yuan.

Going more into detail, from January to June investment in the primary industry equaled 615.9 billion Yuan, rising 27.8 % year-on-year. Investments in the secondary industry were 9,744.6 billion Yuan, representing an increase of 9.3% year-on-year. The National Bureau of Statistics’ figures showed investments in the secondary industry—or the industrial sector of the economy, which is dominated by the manufacture of finished products—declined by 0.4-percentage point year-on-year in the first half 2015. Excess capacity in some industries combined with the low level of domestic consumption is a major problem.

Investments in mining, manufacturing, power, and gas all saw slower growth as well, with mining leading the decline. Investments in mining industry accounted for 526.1 billion Yuan, a decrease of 7.7%.

In the tertiary industry, investments accounted for 13,352.7 billion Yuan, a year-on-year increase of 12.4%. Investments in infrastructure (excluding electricity) totaled 4,060.1 billion Yuan, which increased 19.1% year-on-year.

The National Development and Reform Commission (NDRC), China’s top economic planner, approved several infrastructure projects (worth 884.2 billion Yuan) over the last few months, including the construction and expansion of airports, bridges, high-speed railways, and the improvement of urban transport systems. Throughout 2014, new infrastructure regulations were enacted. Last September the Ministry of Finance (MOF) issued a notice to promote public private partnerships (PPP), encouraging more social capital investment in infrastructure projects. The following month, the State Council decided to streamline approval reviews for infrastructure investment projects. Moreover, new institutions have been established to provide financial support. The most important are the New Silk Road Fund (NSRF) and the Asian Infrastructure Investment Bank (AIIB), which are considered to be the financial arms of the “One Belt, One Road” strategy, that will lead to greater cooperation among countries on the Asian, European, and African continents. Government spending on infrastructure projects is helping to buttress fixed-asset investment, with spending on railways and public facilities likely to continue in coming months.

According to Lian Ping, chief economist at the Bank of Communications, “The central government hopes to support the economy through massive infrastructure investment, partly because investment in the real estate and manufacturing sectors is still weak at the moment”.

A cooling property market has weighed heavily on the economy over the past years. Real estate investment, which directly affects about 40 other business sectors in China, is considered to be a crucial driver of activity. It grew 4.6% in the first half of 2015 from a year earlier, marking the slowest rate since March 2009 (data from the National Bureau of Statistics). Real estate investment was held back by a large inventory surplus. Thus, weak property investment, as an important part of overall investments, will continue to pose one of the biggest risks to China’s economy until its high inventories of unsold homes are cleared.

Many economists expect growth to pick up modestly in the next six months as previous policy easing measures start to take effect and the housing market stabilizes. But other analysts have disputed the view as being unduly optimistic, pointing to huge inventories of unsold homes, excess capacity in many heavy industries, and high levels of local government debt, which is curbing their ability to spend.

Although most economists expect further monetary easing later in 2015, it is unlikely to alter the investment trend as authorities focus on consumption-led growth. Fixed-asset investment is expected to increase well below the strong gains of the previous decades for the foreseeable future, especially if we consider the last announcement from Beijing to cap total outstanding local government debt.